Tag: market

-

ZEC Bullish: Zcash Showing Continued Upside

Quick take on ZEC (Zcash): market shows bullish momentum with defined target areas. Short snapshot — join the Telegram discussion for charts and deeper analysis.

-

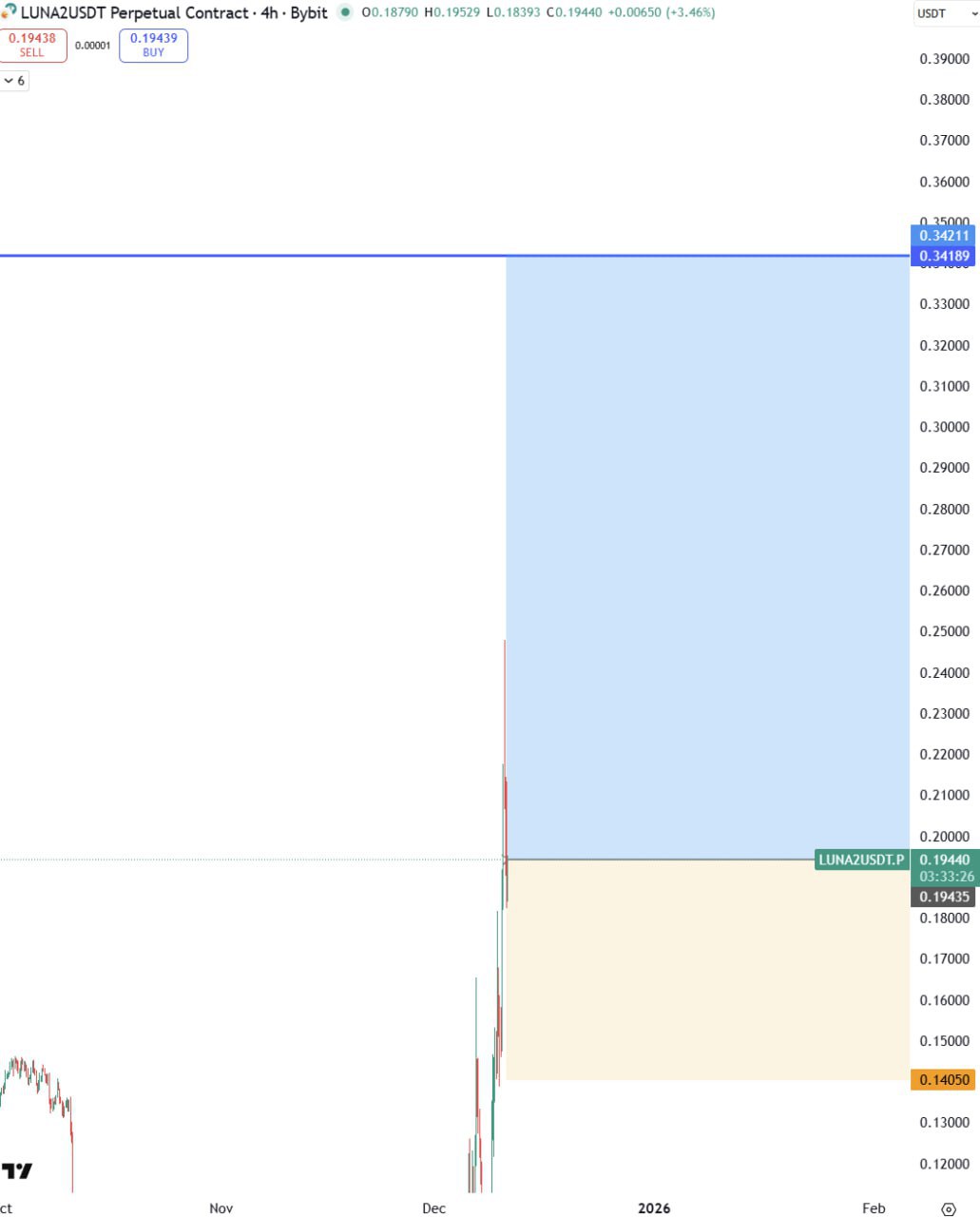

LUNA2 Bullish: Early Signs of Upside Momentum

Quick take: LUNA2 is showing early bullish momentum—watch price action and volume for potential breakouts. Join the discussion in our Telegram channel. #LUNA2 #crypto

-

ZEC Consolation — Zcash Still on Track to $600

Quick update: Zcash (ZEC) remains on a bullish trajectory toward $600 — a short note for traders and holders.

-

LUNA2 Bullish Signal — Short-Term Trading Outlook

Quick take: LUNA2 is showing a bullish signal in recent action. Short-term traders should watch key levels and momentum — check the post for the concise alert and discussion.

-

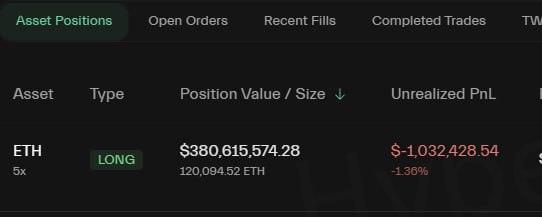

From +$20M to Minus Now — A Raw Crypto Wake-Up Call

A terse, powerful snapshot: “from +20M to minus now” — a stark reminder of crypto market volatility and the real risk traders face. Read the unedited post and join the discussion in our Telegram channel.

-

Hyperdash Trader Profile — 0xb317d2bc2d3d2df5fa441b5bae0ab9d8b07283ae

Snapshot of a Hyperdash trader profile for address 0xb317d2bc2d3d2df5fa441b5bae0ab9d8b07283ae — inspect on-chain activity and trades on Hyperdash.

-

Is the Market Hunting the Whale? 2 Possible Scenarios

A quick look at a sudden market move: it could be an automated program targeting the largest whale, or the whale itself shorting across multiple accounts. Check orderbooks and positions to tell which is more likely.

-

Market Programmed to Hunt the Biggest Whale — Traders Alert

Short-term market action looks ‘programmed’ to target the largest whale — a development that may amplify liquidity swings and volatility. Watch position flows and stop clusters closely.

-

Comparing Bitcoin Crash Recovery Models: Practical Insights for International Investors

This data-driven guide compares bitcoin crash recovery models for international investors using November 2025 market data: BTC trading in the low $80k range, record November ETF outflows near $3.7–$3.8B, and options-implied tail risk signalling ~50% probability of year-end below $90k. We assess four operational recovery models — Buy-the-Dip, Systematic DCA, Tactical Event-Driven Rebalancing, and Hedged…

-

You Know What Comes Next? — A Short Crypto Teaser

A short, suspenseful crypto market teaser: “You know what will come next?” Read the brief prompt on our blog and join the Telegram channel to share predictions, setups, and market analysis.