Tag: cryptocurrency

-

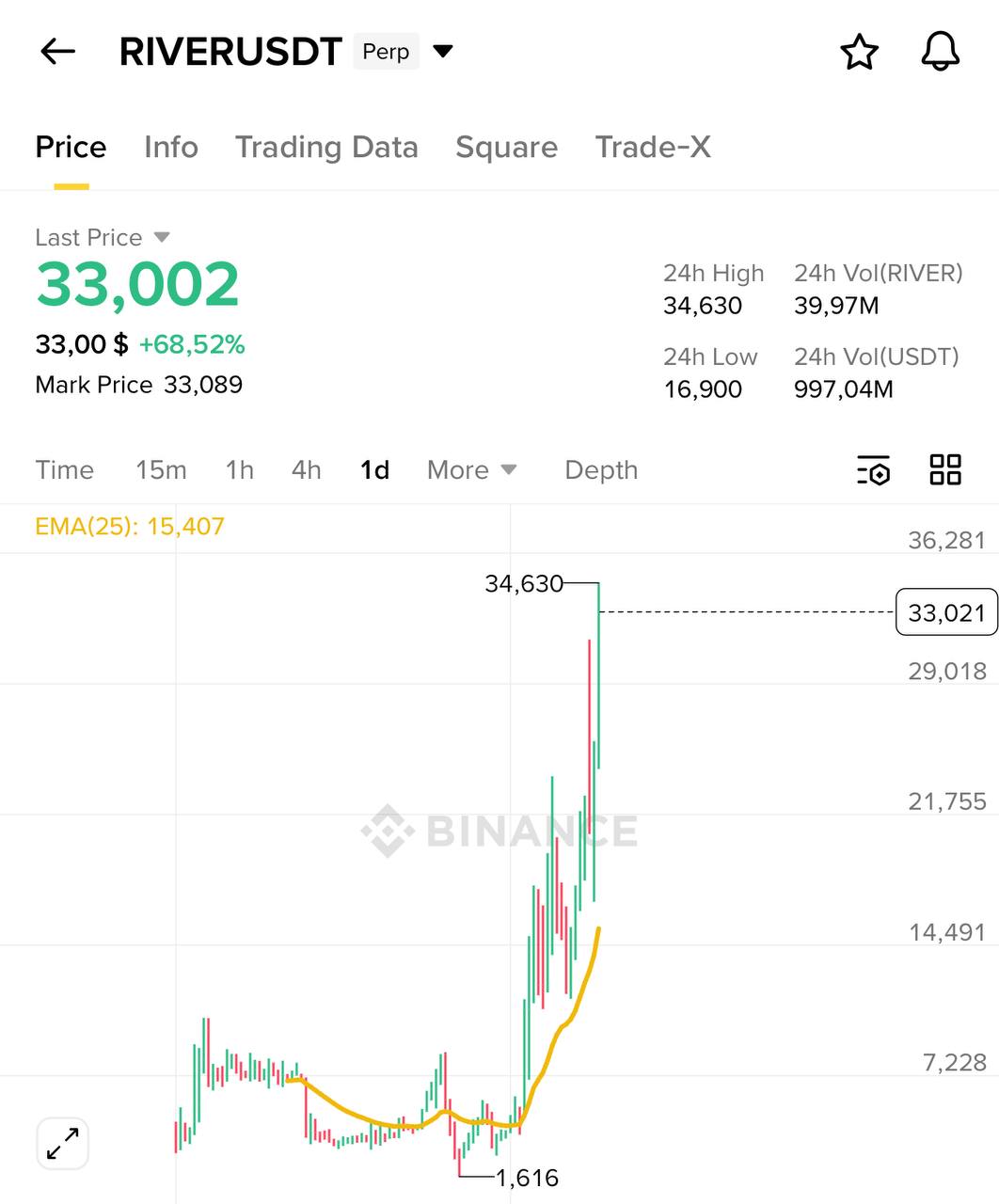

Crypto Chart Snapshot: Price Action Lacks Clear Entry/Exit Signals

A quick chart snapshot showing cryptocurrency price movements, indicators and volume — but no clear entry, exit, or stop-loss levels are visible. Read the full post and join the discussion in our Telegram channel.

-

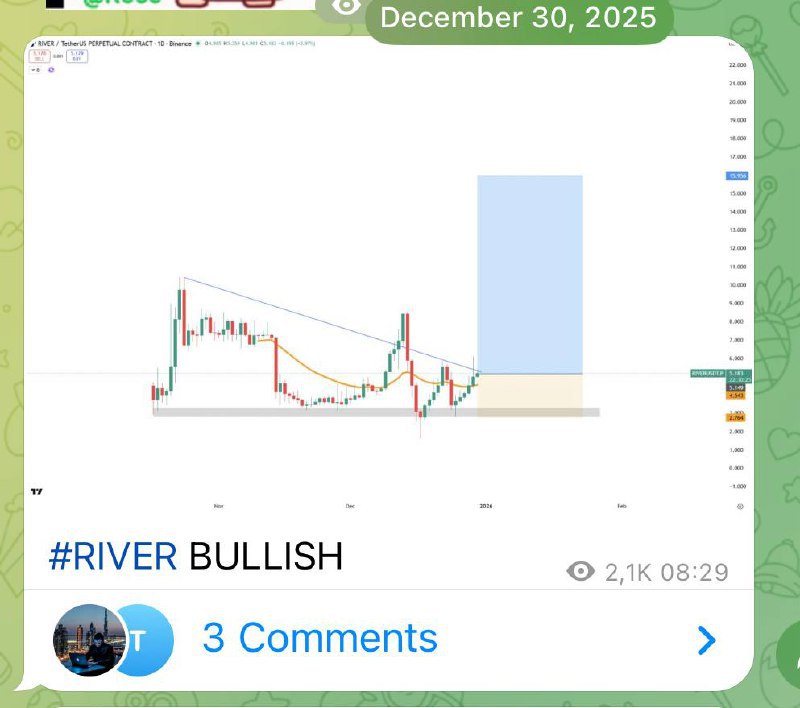

RIVER — Bullish Outlook & Chart Signals

RIVER shows emerging bullish signals on recent charts and on-chain metrics. Read the concise analysis and market context in our Telegram channel to see why RIVER might be positioned for an upside.

-

Dash Is the New ZEC — A Short Take on Privacy Coins

A short opinion: ‘Dash is New Zec’ — a quick take on why Dash may be stepping into Zcash’s privacy role and what that could mean for privacy coins and the wider crypto market.

-

DASH & ZEN — Quick Market Snapshot and Chart Highlights

Quick chart snapshot: DASH and ZEN price action vs USDC, highlighting recent trends and potential movements. Read and discuss in our Telegram channel.

-

Dash Is the New Zec — A Short Take on Privacy Coins

A short take arguing Dash mirrors Zcash’s privacy-focused stance and market behavior. Read the brief post and join the discussion in our Telegram channel.

-

U R Not Prepared: What’s Coming in Crypto

Short urgent warning for crypto holders and traders — a blunt note on incoming market shifts. Read the full post and prepare your positions.

-

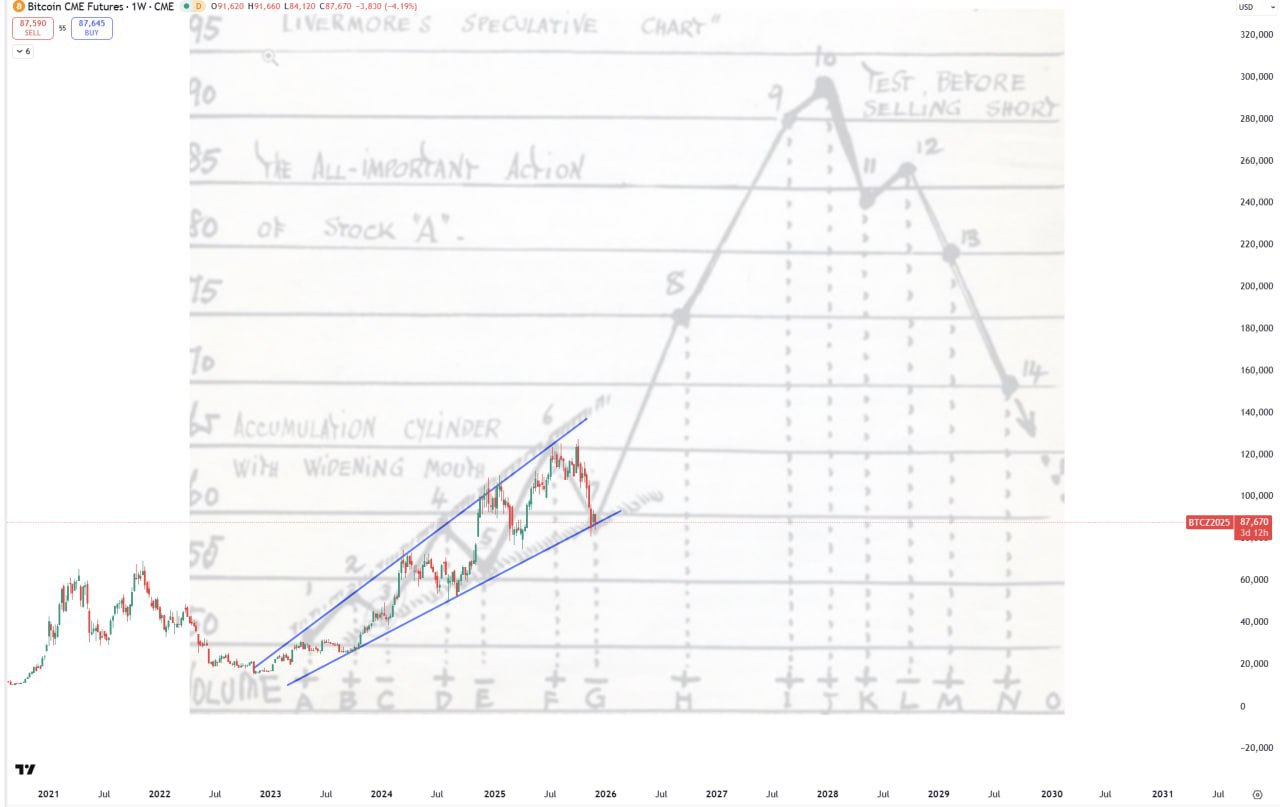

Interesting Pattern Spotted in Bitcoin Futures

Spotted an interesting pattern in Bitcoin futures — a brief observation with potential trade implications for BTC traders. See the chart and join the discussion in our Telegram channel.

-

BTC Bull Momentum: Bitcoin Eyes Further Upside

Brief bullish alert on Bitcoin: price action suggests continued upside for BTC. Read the short update and join the discussion in our Telegram channel.

-

Chart Rundown: DOGE, ETH & ZRO Bullish Setups

Quick chart roundup highlighting bullish setups in Dogecoin, Ethereum, and ZRO — a concise briefing for traders looking for short-term breakout opportunities and market context.

-

Privacy Season Kicks Off Jan 10 — Which Project Will Win?

Privacy season begins Jan 10 — a short take on which privacy-focused crypto projects could emerge ahead. Join the discussion in our Telegram channel to weigh in.