Tag: bitcoin

-

This Is a Sign — Quick BTC & ETH Market Signal

A concise market note: a potential signal for Bitcoin and Ethereum price action. Read the short post and join the discussion in our Telegram channel to dive deeper.

-

Market Signals: BTC, DOGE, ETH & ZRO — Chart Analysis and Trade Ideas

Quick chart-driven insights: long-term cycles, a DOGE long setup, an ETH short signal, and a ZRO breakout projection — key levels and trade ideas for traders and analysts.

-

Breakout Confirmed — Accumulation Zone Broken

Market update: technicals show a breakout above the accumulation zone. This shift may change momentum for Bitcoin and altcoins — monitor price action, volume, and potential retests. Join the Telegram discussion for deeper analysis.

-

BTC < ETH < beta ETH (Pepe) — Quick Market Take

Quick market take comparing BTC, ETH and meme ‘beta ETH’ (Pepe). A short snapshot for crypto traders and analysts — BTC vs ETH vs Pepe.

-

BTC Adding — Potential Buy Setup for Bitcoin

Short update: BTC adding — chart shows a potential buy setup with a price target for future upside. Quick read for traders and analysts. Discuss in our Telegram channel.

-

Crypto Market Chart Analysis — Latest Trading Signals

Visual chart analysis highlighting trading signals, buy/sell zones, and target areas across major cryptocurrencies. Quick insights for traders and market watchers — see the full breakdown in our Telegram channel.

-

One or Few Kisses to Breakout? — Bitcoin & Crypto Market Pulse

Quick market note: Will Bitcoin and major altcoins need one or a few retests (“kisses”) of resistance before a decisive breakout? Short, chart-focused question for traders watching upcoming market moves.

-

Sky Is Clear Above $94k — Bitcoin Eyes Upside Breakout

Short market note: Bitcoin shows bullish clarity above $94,000 — watch for a breakout and follow volume for confirmation.

-

Break 94k — Bitcoin Poised for a Strong Move

Bitcoin is testing the 94k area — a breakout could spark a sharp directional move. Monitor price action and volume for trading opportunities.

-

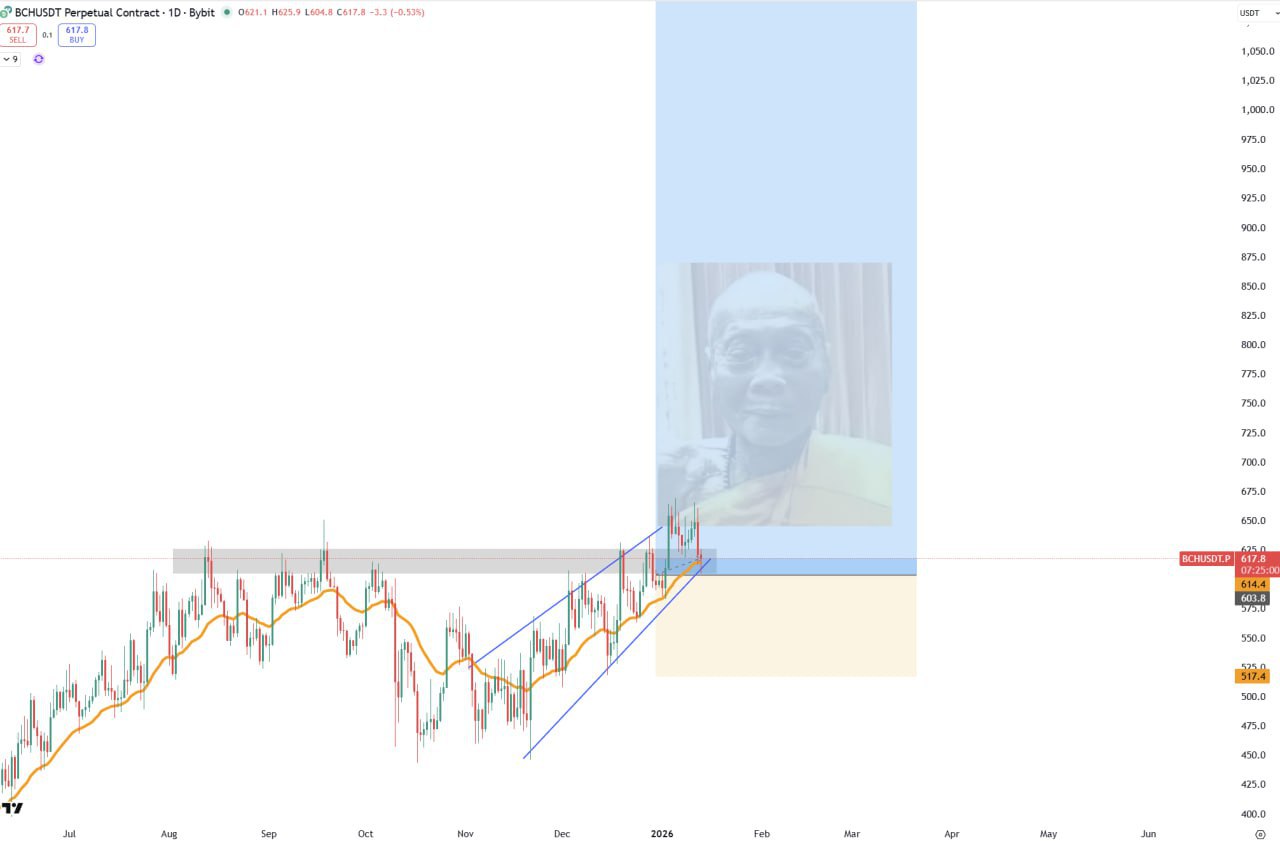

Mid-Big Caps Watch: Next Focus — BCH & XMR

Short market note: Mid–big cap attention shifting to BCH and XMR. Quick alert for traders and holders to watch price action and news around Bitcoin Cash and Monero.