Tag: bitcoin

-

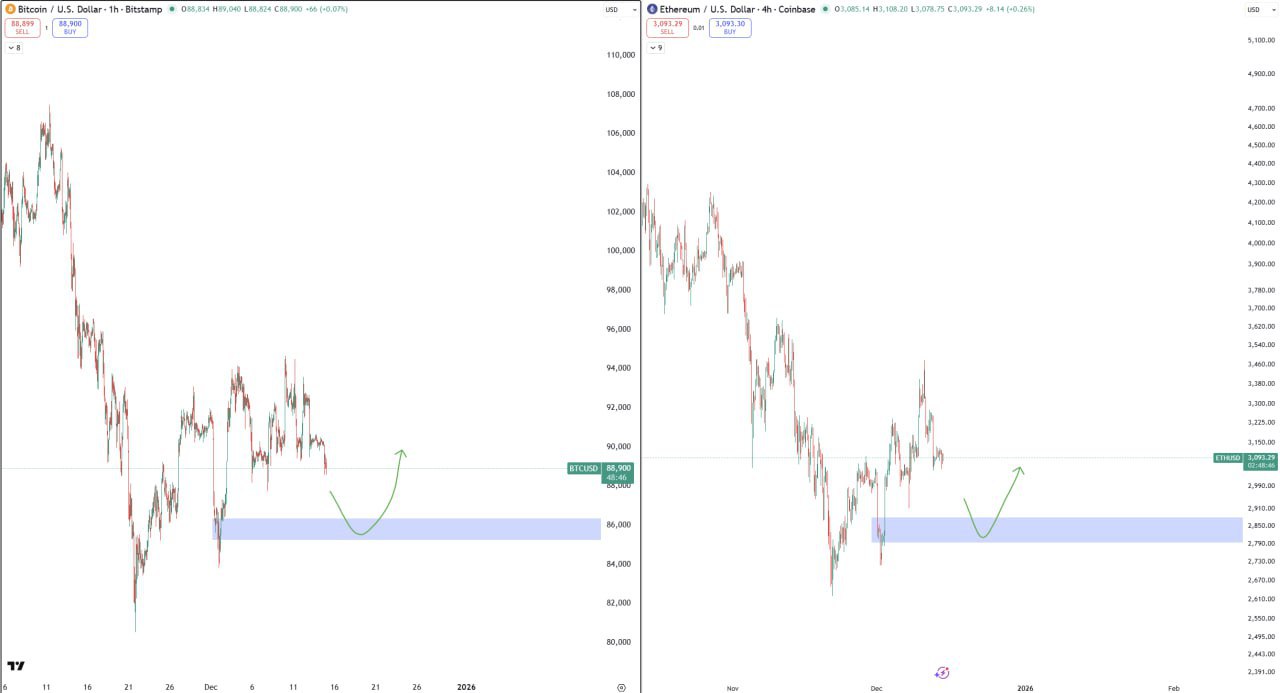

Re-LONG — Bitcoin Long Setup

Re-LONG — a quick note on a potential Bitcoin long setup with suggested stop-loss. Review the chart notes, manage risk, and discuss in our Telegram channel. #roses_leaks

-

BTC Trade Signal — Long Position with 1.5% Stop Loss

Quick BTC trade signal: go long on Bitcoin with a tight 1.5% stop loss. Join our Telegram channel for discussion and updates.

-

CLOSE #BTC — Bitcoin Position Closed (Market Alert)

Signal: CLOSE #BTC — Bitcoin position closed. Immediate market alert — read the post and join our Telegram channel for details and discussion.

-

LONG BTC — Stop Loss 1.5% | Trade Alert

Trade alert: entering a long on BTC with a 1.5% stop loss. Short-term directional trade — manage risk and position size accordingly.

-

Close Short Positions on BTC & ETH — Market Alert

Urgent market alert: Close short positions on BTC and ETH. Manage risk, secure gains, and monitor volatility — essential action for traders amid shifting market conditions.

-

BTC & ETH Short Alert — Quick Market Signal

Quick short alert: Bitcoin and Ethereum showing short signals. Potential downside momentum — join our Telegram channel for live discussion and trade ideas.

-

BTC & ETH — Quick Market Snapshot

Quick market snapshot for BTC & ETH. Stay on top of Bitcoin and Ethereum price action and potential setups. Join our Telegram channel for the full update and trade ideas.

-

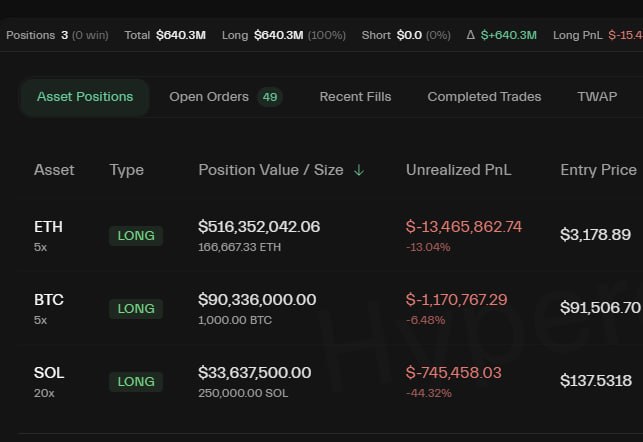

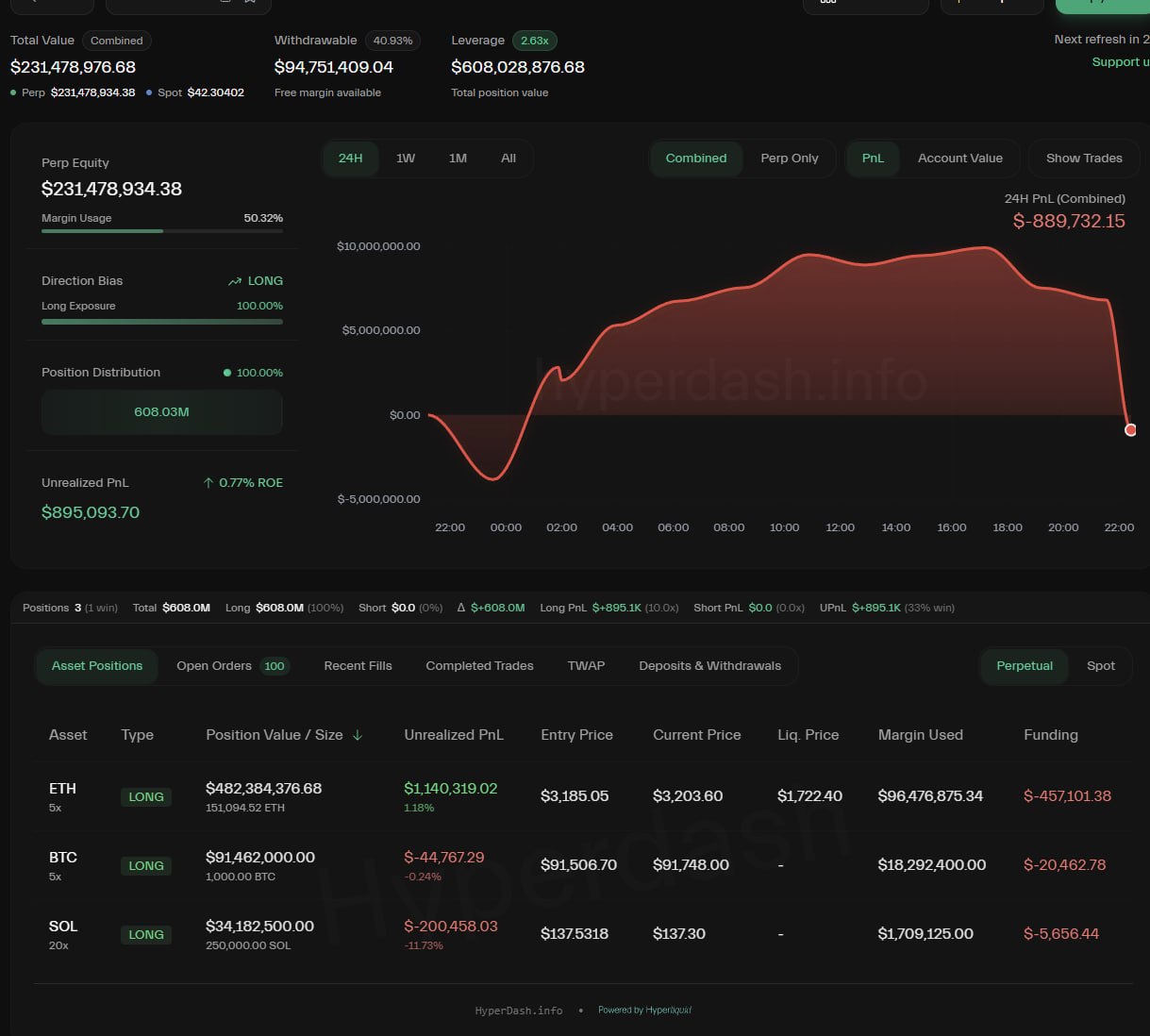

Trader Reaction: ‘holysht’ — Unrealized PnL Pain on ETH, BTC & SOL

A terse trader reaction to major unrealized PnL on ETH, BTC and SOL. A quick snapshot of market pain and why risk management matters — join the discussion on our Telegram channel.

-

If ZEC Hits $600 This Weekend, Will BTC Turn Red and a Whale Fail?

Short market speculation: If ZEC (Zcash) spikes to $600 this weekend, BTC could see a pullback next week and a large whale’s position may fail. Quick take for traders watching inter-market correlations.

-

BTC Ascending Triangle Near Breakout — Key Levels to Watch

Bitcoin has formed an ascending triangle and looks poised for a breakout. Monitor horizontal resistance, the rising support trendline, and volume for confirmation and potential targets.