Tag: analysis

-

Bitcoin’s Role in Global Economic Uncertainty: A Safe Haven or Speculative Asset?

A data-driven, practical analysis of Bitcoin’s role during economic downturns. Using current November 2025 price feeds, academic studies and recent market events, this article evaluates whether Bitcoin functions as a true safe haven or remains a speculative, high-beta asset. Includes actionable risk-management guidance, technical and strategy links, and a Premium Signal CTA for traders who…

-

Volume Revealed the Truth: Market Signal from Trading Volume

Trading volume confirmed the market signal — a concise insight into why volume exposed the real trend.

-

Buy When There’s Blood in the Streets — Contrarian Crypto Wisdom

A classic contrarian trading maxim for crypto: consider buying during panic. A short reminder that market fear can present opportunity for disciplined investors.

-

Buy When There’s Blood in the Streets — Why Panic Creates Opportunity

A timeless market aphorism: buying during panic often yields outsized returns. A short reminder for crypto traders to manage risk, size positions and look for opportunity in volatile markets.

-

BTC Long Setup — Potential Buy Zone

Quick BTC long alert: potential buy zone identified. Short update for traders watching a breakout — check the post in our Telegram channel for visuals and context.

-

Bitcoin ETFs: The Gateway to Mainstream Cryptocurrency Investment

Bitcoin ETFs have transformed access to cryptocurrency markets by offering regulated, brokerage-friendly exposure to bitcoin without private-key management. As of Nov. 19, 2025, ETF mechanics move markets: Reuters reported a $523M single-day withdrawal from BlackRock’s IBIT and Bloomberg documented a $870M pull earlier in November, showing how flows can amplify volatility. ETFs reduce custody and…

-

BTC V-Shape Recovery: What It Means for Traders

Bitcoin is showing a V-shaped recovery — a rapid rebound that could signal renewed bullish momentum. Watch resistance levels, volume, and confirmation before trading. Join the discussion in our Telegram channel. #bitcoin #BTC #roses_leaks

-

Case Study: How Top Traders Navigated Bitcoin’s 2025 Price Volatility for Profit

This case study examines how top traders turned Bitcoin’s 2025 volatility into profit. Using verified market datapoints (BTC trading near $91k on Nov 19, 2025; BlackRock IBIT one-day outflow of $523.2M), we profile successful trader archetypes — prop desks, quant funds, and disciplined retail — and the techniques they used: options overlays, futures basis trades,…

-

Breaking News Analysis: November 2025 Bitcoin Market Dip Explained for Global Traders

November 2025 brought a fast corrective phase in Bitcoin, with price action sliding into the low $80,000s and intraday tests near $80,000. This analysis (Nov 21, 2025) synthesizes Reuters, Bloomberg, CNBC and ETF flow reports to explain macro drivers, AI/tech correlations, regional market reactions, and tactical trading setups. It includes support bands observed mid‑month ($92k–$96k),…

-

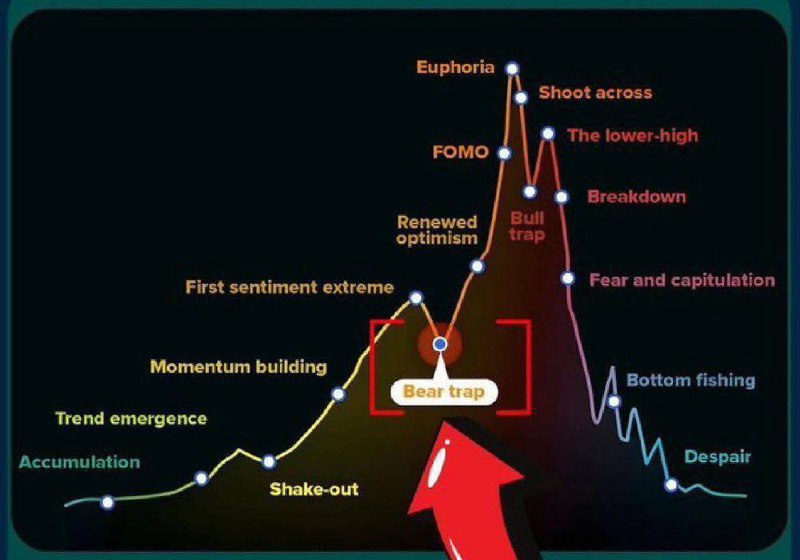

Trading Signals & Sentiment: DOGE, ETH and ZRO Charts Breakdown

A concise look at trading sentiment and chart signals across Dogecoin, Ethereum and ZRO — key levels, buy/sell zones and market emotions traders should watch.