Category: thoughts

-

How It Started — A Crypto Beginning

A brief reflection on beginnings in the crypto world. A short, simple note titled “How It started” — join the discussion in our Telegram channel to read more.

-

Rose Army: Where Legendary Trades Begin — Discuss

Rose Army has a reputation as the birthplace of legendary crypto trades. Join the discussion on how community intel and crowd sentiment shape market moves — share your insights in our Telegram channel.

-

Okay Bros — Crypto Micro-Post

Micro-update from our crypto blog: “Okay bros”. Short informal post — join the discussion in our Telegram channel. #roses_leaks #crypto

-

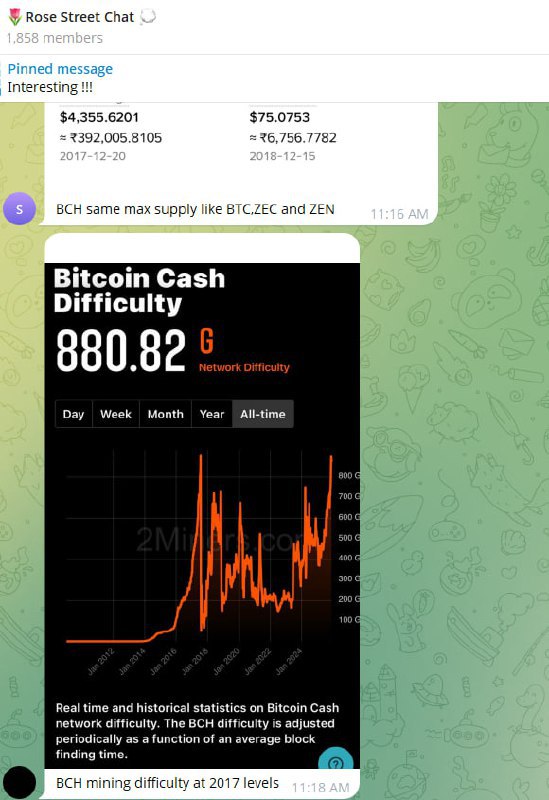

Interesting! A Short Crypto Thought

A brief, intriguing note: “Interesting !!!” — join the discussion in our Telegram channel for reactions and context.

-

Quantum Threat to Bitcoin — BCH Claims to Be the ‘Quantum-Bitcoin’

A short, provocative post arguing that quantum computing is the largest risk to Bitcoin and claiming Bitcoin Cash (BCH) is the solution — branding BCH as the ‘quantum-bitcoin’ and ‘new bitcoin’. Read the full post in our Telegram channel.

-

Nobody Talking About It — A Quiet Crypto Signal

A short, sharp note on an overlooked crypto market signal — something few are discussing right now. Take a moment to consider what the charts and on-chain data might be missing.

-

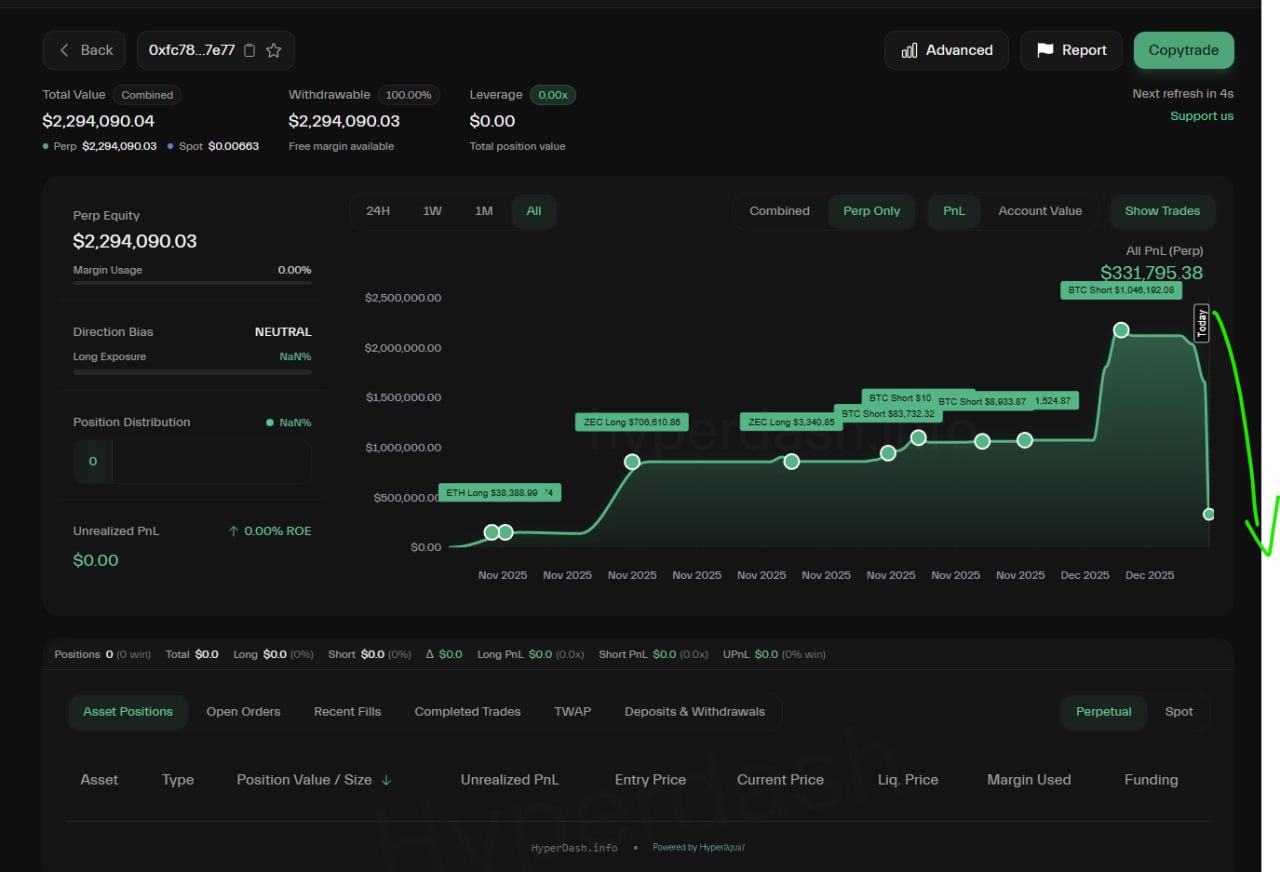

Burj Khalifa Pattern Everywhere — 10/10 Winning Streak to $2M, Then Back Near Zero

Trader hit a 10/10 winning streak using the ‘Burj Khalifa’ pattern, pushing PnL from $0 to $2M before a final trade wiped most gains. See the trader profile and charts for details.

-

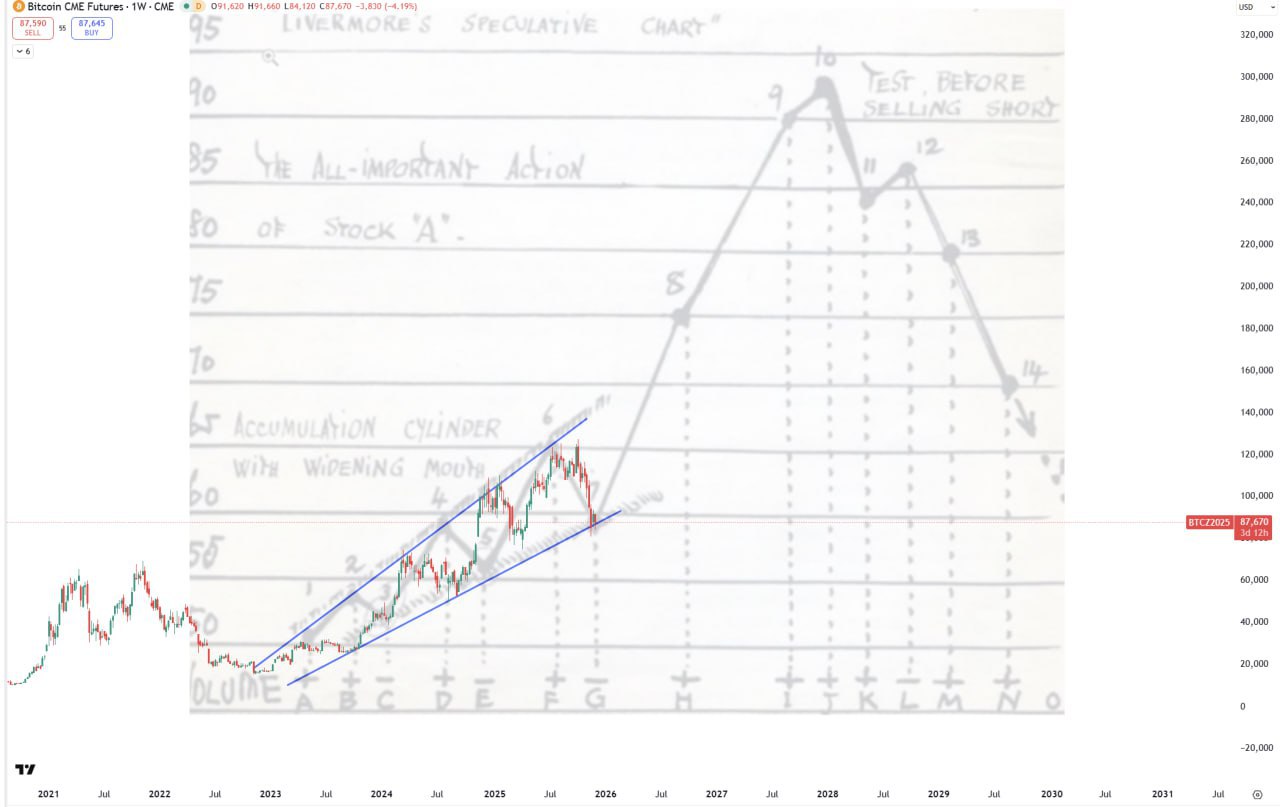

FUDs Marked the Bottom — What This Means for Crypto Markets

Short take: widespread FUD often signals capitulation and can mark a local market bottom. Watch for accumulation, volume shifts and early reversal signals before positioning.

-

Market Moves: ZEC Rises When Market Falls — And Vice Versa

Short crypto note: ZEC has recently moved opposite to the broader market — spiking during dips and cooling off during rallies. A quick reminder of strange correlations in crypto trading and why watches on altcoin behavior matter.

-

Case Study: Profiting from DeFi Token Pangaea’s Market Surge in 2025

This case study analyzes how traders profited from the 2025 Pangaea/Pangea token surge amid a returning DeFi market. We verify 2025 market context (CoinGecko Q3 TVL +40.2%, Statista US DeFi revenue ~$2.5bn), detail contract-verification workflows, liquidity-adjusted position sizing, cross-venue arbitrage, and region-driven USD impact. Actionable strategies include pre-trade contract checks, scaled entry via ladders, LP…