Category: setup

-

Visual Crypto Trading Setups — DOGE Buy, ETH Short, ZRO Long

Quick visual roundup of four crypto chart setups: an art-themed cityscape, a DOGE buy area, an ETH short setup, and a ZRO long idea. Images suggest trade themes but do not give explicit entry/exit rules.

-

Buying PEPE — Quick Trade Note & Setup

Short trade note: considering a buy on PEPE based on a current trading setup. Quick market insight for meme-coin traders — discuss in our Telegram channel.

-

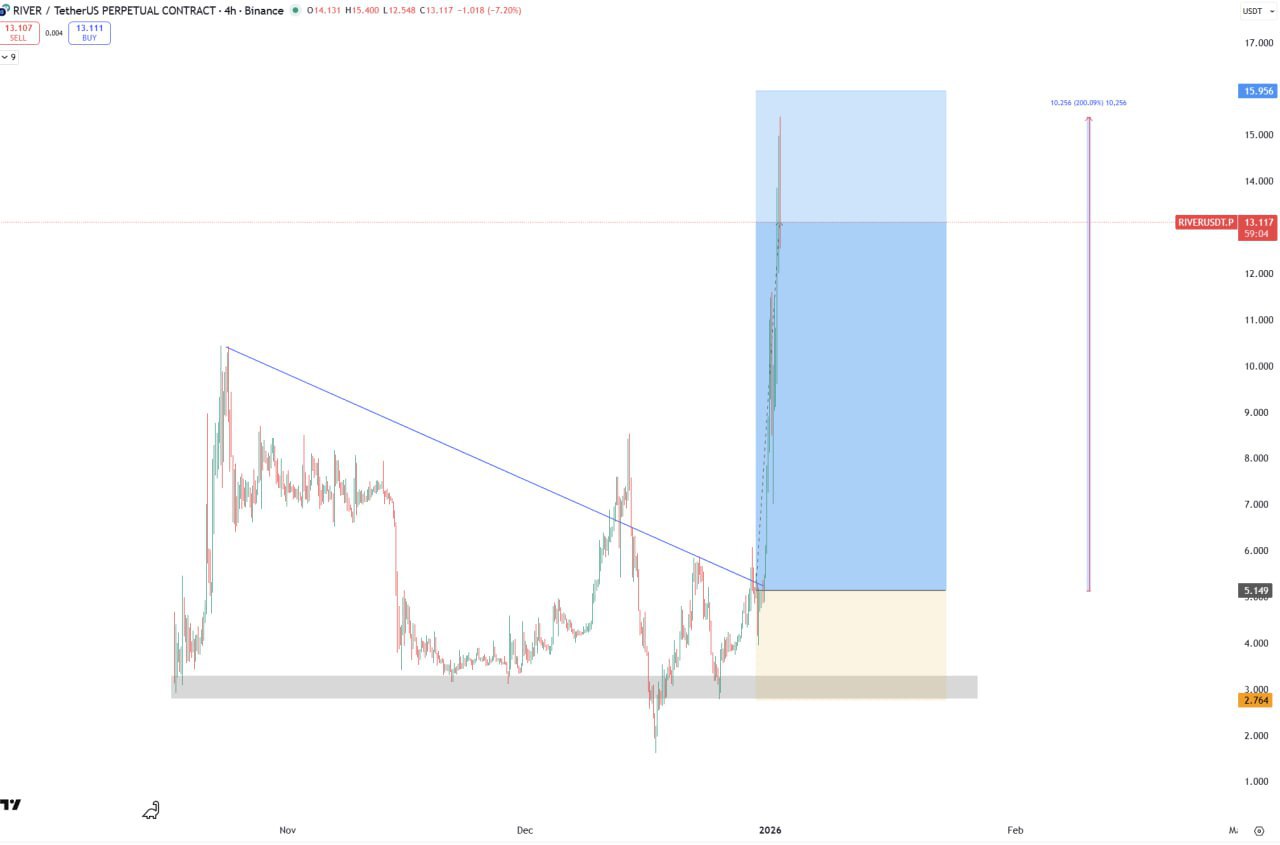

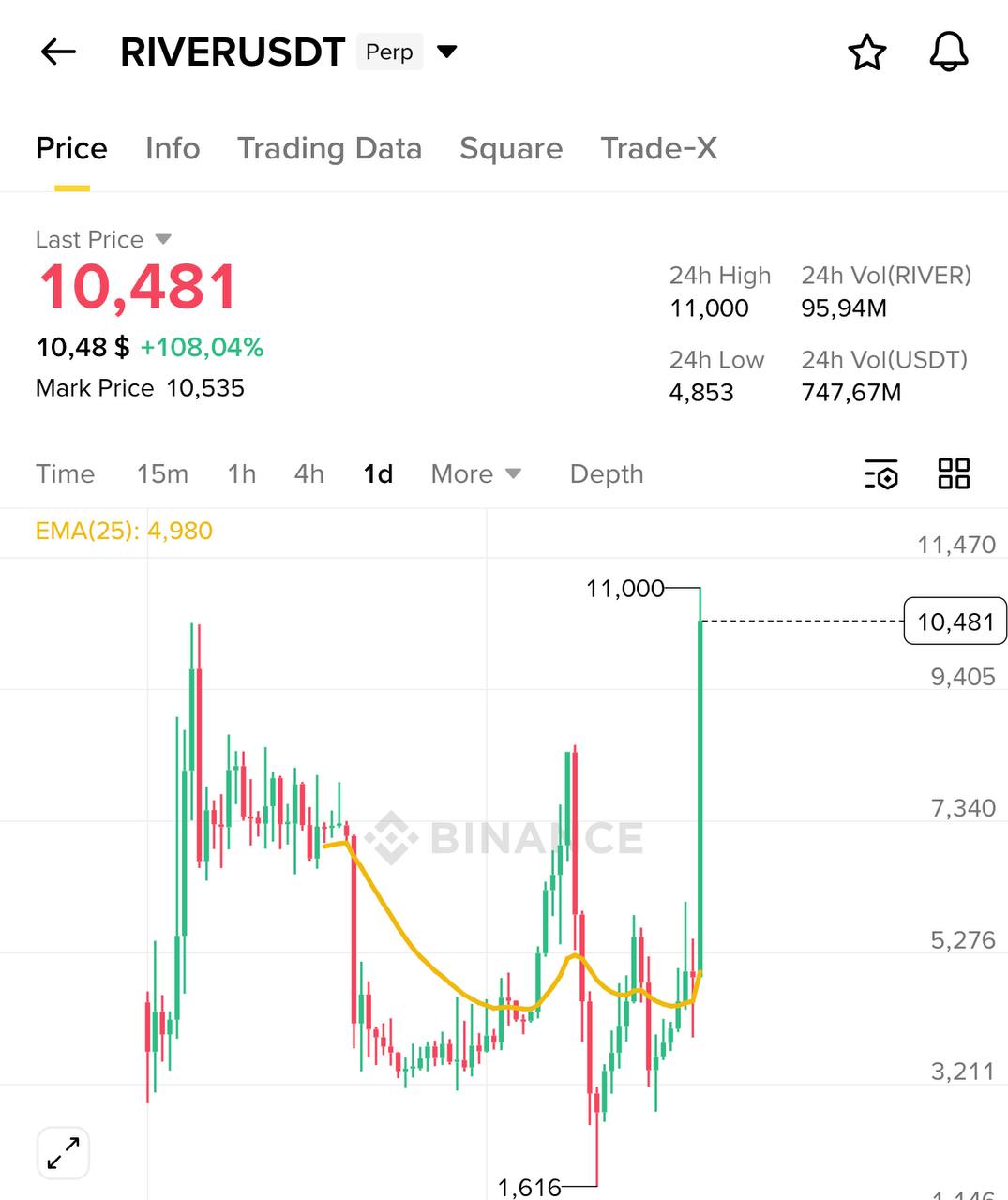

RIVER x3 — Bullish Crypto Signal

Market alert: RIVER shows a potential x3 bullish setup. Short, sharp signal for traders and crypto investors — check the post and join the discussion in our Telegram channel.

-

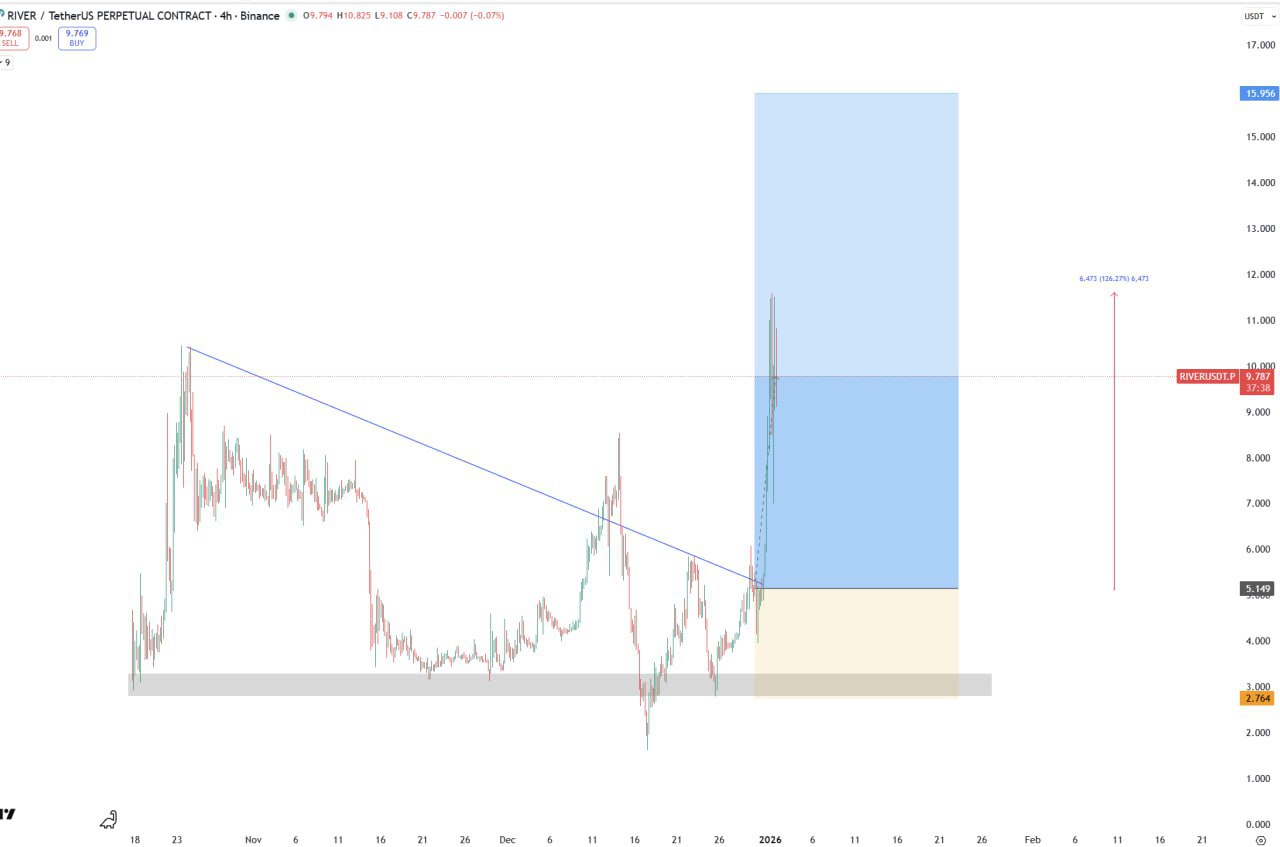

RIVER +125% — Leverage Warning & Large-Frame Setup

RIVER surged +125%. Reminder to manage leverage: altcoins can swing 10–20%. Use large-timeframe setups, wide stops and proper position sizing to avoid unnecessary risk.

-

ZEC — Add More Positions (Trading Setup)

ZEC trading setup: plan to add more positions at marked support levels. Image shows clear levels to watch for entries and risk management. Join our Telegram channel for live discussion and trade alerts.

-

ZEC — Add More Positions (Trading Setup)

ZEC trading setup: plan to add more positions at marked support levels. Image shows clear levels to watch for entries and risk management. Join our Telegram channel for live discussion and trade alerts.

-

Rose Street Group Moving to a New Private Telegram Channel — Join the Discussion

Rose Street Group is moving to a new private Telegram channel. Members should join the group chat to receive the invite link (posted in the next few days). See the Desktop & Mobile App guides for setup instructions.

-

ZRO Trading Setup: Bullish Entry & Exit Points

Quick breakdown of a bullish ZRO trading setup with suggested entry, exit and target levels. Chart shows clear zones for managing risk and profit — join our Telegram channel for full analysis and live updates. #roses_leaks

-

88888 — Crypto Trading Snapshot

Quick crypto trading snapshot: 88888. A concise post for traders and analysts — read the full update in our Telegram channel.

-

What Is Your Conclusion? Share Your Crypto Market Takeaways

Quick prompt: review the charts and trading setups (DOGE, ETH, ZRO and more) — what’s your conclusion? Share your take and join the discussion in our Telegram channel.