Category: setup

-

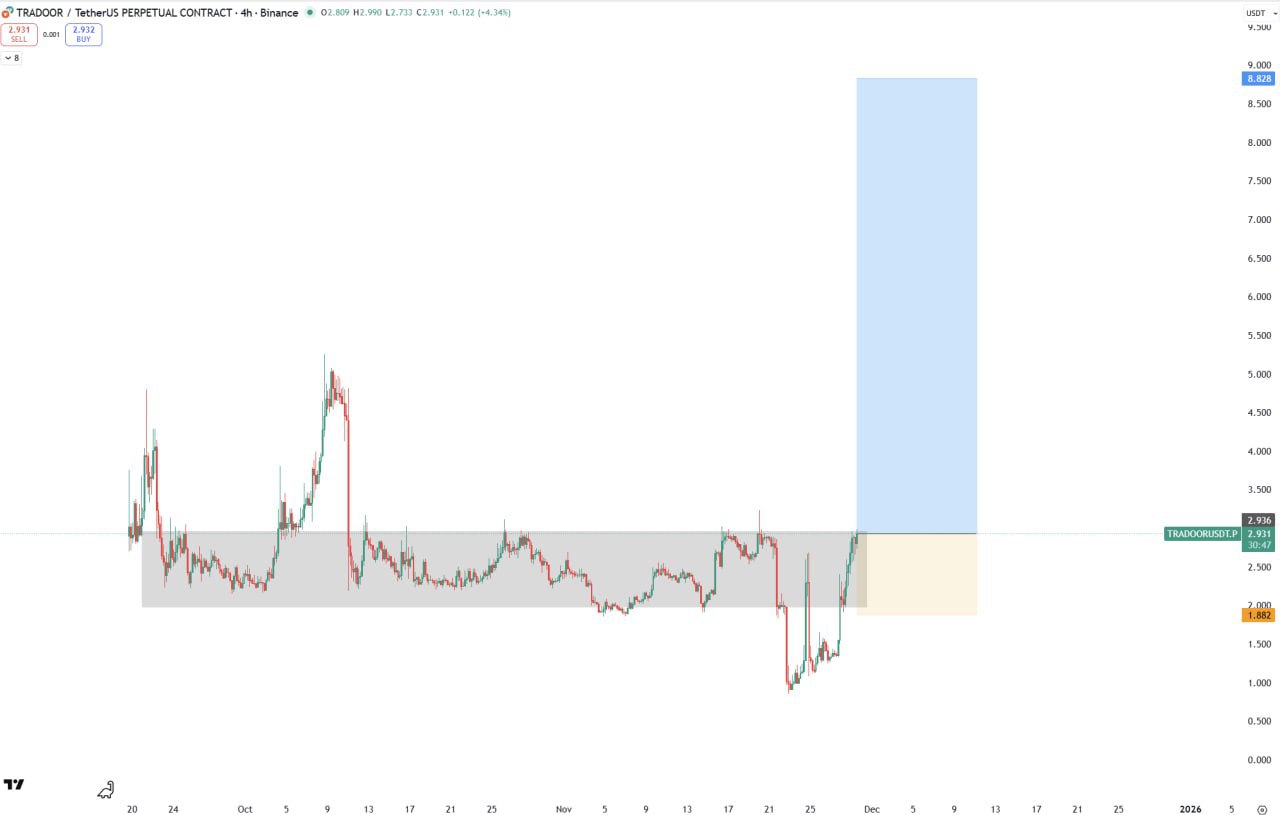

TRADOOR Bullish Setup on Binance: Breakout Potential

TRADOOR shows a bullish trading setup on Binance with breakout potential and a clear upside target — a concise chart-led note for traders watching entries and targets.

-

AT BULLISH — Quick Crypto Trading Setup

Quick take: #AT BULLISH — a succinct bullish trading setup highlighting entry and target zones for crypto traders. Join our Telegram channel to discuss trade ideas and chart levels.

-

Market Setups: BTC vs ETH, DOGE & ZRO — Key Support & Resistance

Visual market breakdown: BTC vs ETH price action plus DOGE and ZRO trading setups. Key support and resistance levels called out — quick chart-driven insights for traders and analysts.

-

AT BULLISH — Quick Crypto Momentum Signal

Brief alert: market shows bullish momentum. A short post signaling upside potential in crypto — join our Telegram channel to discuss the setup and trade ideas.

-

Ultimate Guide to Navigating Cryptomarket Shifts in 2025: Strategies for Global Traders

This data-driven ultimate guide helps traders navigate 2025 crypto volatility. Learn why BTC and ETH moved in November 2025, how Nvidia earnings ripple through markets, how to size hedges, and step-by-step DeFi/NFT diversification plans. Actionable setups and risk templates included—subscribe to Premium Signal for live trade alerts.

-

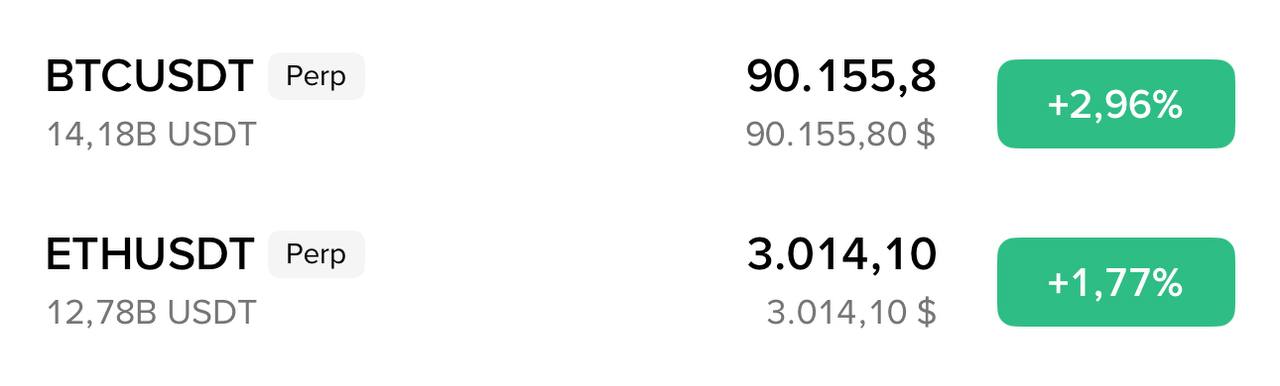

Buy More BTC at 90k and ETH at 3k — SL at Previous Setups

Short market note: adding to BTC at $90k and ETH at $3k with stop-losses kept at previous setup levels. Quick trade alert for crypto traders tracking BTC and ETH positions.

-

Loto Trade — RVVUSDT Snapshot & Setup

Short market snapshot: ‘Loto trade’ — a trading setup on RVVUSDT. Review the price action, chart structure and manage risk before entering. Join the discussion in our Telegram channel for deeper analysis.

-

FARTCOIN Bullish — Quick Market Note

FARTCOIN shows a bullish trading setup — a quick market note for crypto traders and analysts watching potential upward momentum.

-

Bitcoin ETFs: The Gateway to Mainstream Cryptocurrency Investment

Bitcoin ETFs have transformed access to cryptocurrency markets by offering regulated, brokerage-friendly exposure to bitcoin without private-key management. As of Nov. 19, 2025, ETF mechanics move markets: Reuters reported a $523M single-day withdrawal from BlackRock’s IBIT and Bloomberg documented a $870M pull earlier in November, showing how flows can amplify volatility. ETFs reduce custody and…

-

Case Study: How Top Traders Navigated Bitcoin’s 2025 Price Volatility for Profit

This case study examines how top traders turned Bitcoin’s 2025 volatility into profit. Using verified market datapoints (BTC trading near $91k on Nov 19, 2025; BlackRock IBIT one-day outflow of $523.2M), we profile successful trader archetypes — prop desks, quant funds, and disciplined retail — and the techniques they used: options overlays, futures basis trades,…