Category: blog

-

STRK Bullish: Momentum Breakout Signals for STRK Token

STRK is showing bullish momentum — a potential breakout setup to watch. Short update on STRK price action and what traders should monitor. Join our Telegram channel for discussion.

-

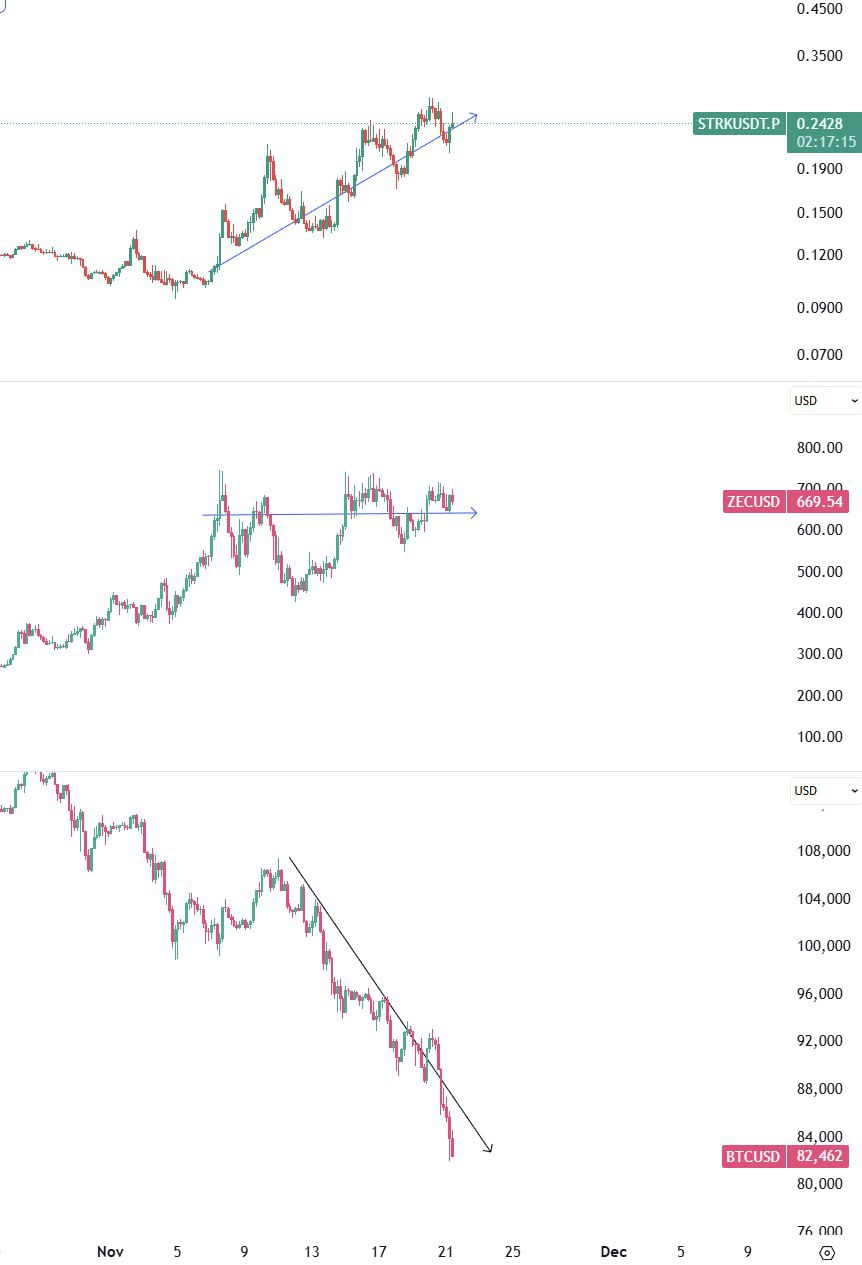

BTC, ZEC & STRK — Quick Crypto Update

Quick update highlighting BTC, ZEC and STRK. Short crypto note for traders and enthusiasts — join our Telegram channel to discuss. #roses_leaks

-

Wait, what? — Quick reaction to surprising BTC price action

A brief, surprised reaction to recent BTC chart behavior — consolidation on the top chart and a downward trend below. Read the short post and join the discussion in our Telegram channel.

-

ZEC (Zcash) — Quick Note

A short mention of ZEC (Zcash). Check this brief post for a quick update on ZEC and join the conversation in our Telegram channel.

-

Quick Crypto Note: That Coin Looks Interesting

Short crypto take on an interesting coin to watch — a quick insight for traders and investors.

-

ZRO Trading Setup: Price Targets & Active Zone

ZRO trading setup outlining potential price targets and a defined active trading zone. Practical snapshot for traders looking to plan entries and exits in the current crypto market.

-

Bitcoin’s Volatility: A Double-Edged Sword for Investors

Bitcoin remains the most volatile major asset in 2025: trading around $90k on Nov 19, 2025 with market cap near $1.8T and recent drawdowns of ~29% from the year’s highs. This data-driven guide analyzes historical patterns, explains how volatility alters trading and allocation choices, and gives concrete risk-management techniques (position sizing, hedging, leverage controls, and…

-

ZEC (Zcash) Trade Setup — TP1: 888

ZEC (Zcash) trade setup — first profit target (TP1) set at 888. Quick signal for traders and market watchers. Monitor price action and manage risk.

-

Zec — Quick Note on Zcash (ZEC)

A brief note on Zcash (ZEC) — a privacy-focused cryptocurrency and its relevance in the crypto market.

-

Comparing Bitcoin Recovery Models: Which Strategy Works Best Globally in 2025?

This in-depth comparison evaluates the three leading bitcoin recovery models in 2025 — Technical Bounce-Back, Fundamental Recovery, and Sentiment-Driven Rebound — using current November 2025 market data. With bitcoin trading in a wide range (recent intraday lows around $89k and highs above $116k in October–November windows), traders must match model choice to region, liquidity and…