Category: blog

-

Double Bottoms: Spotting Bullish Reversals in Crypto

A concise look at the double bottom chart pattern in cryptocurrency markets — learn how to identify it and why traders treat it as a potential bullish reversal signal.

-

MIRA Bullish — Quick Market Alert

MIRA Bullish — Quick market alert: MIRA shows bullish momentum vs USDT. Short update for traders and analysts. Join our Telegram channel to discuss the outlook and potential setups.

-

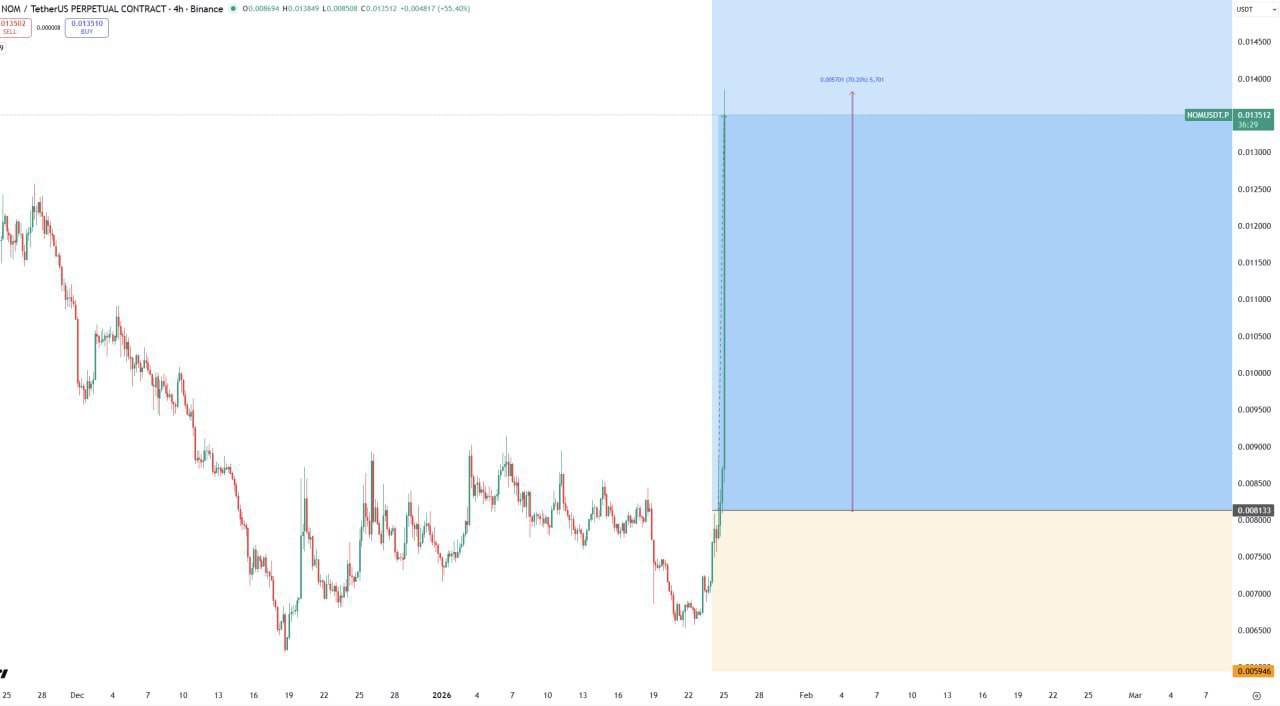

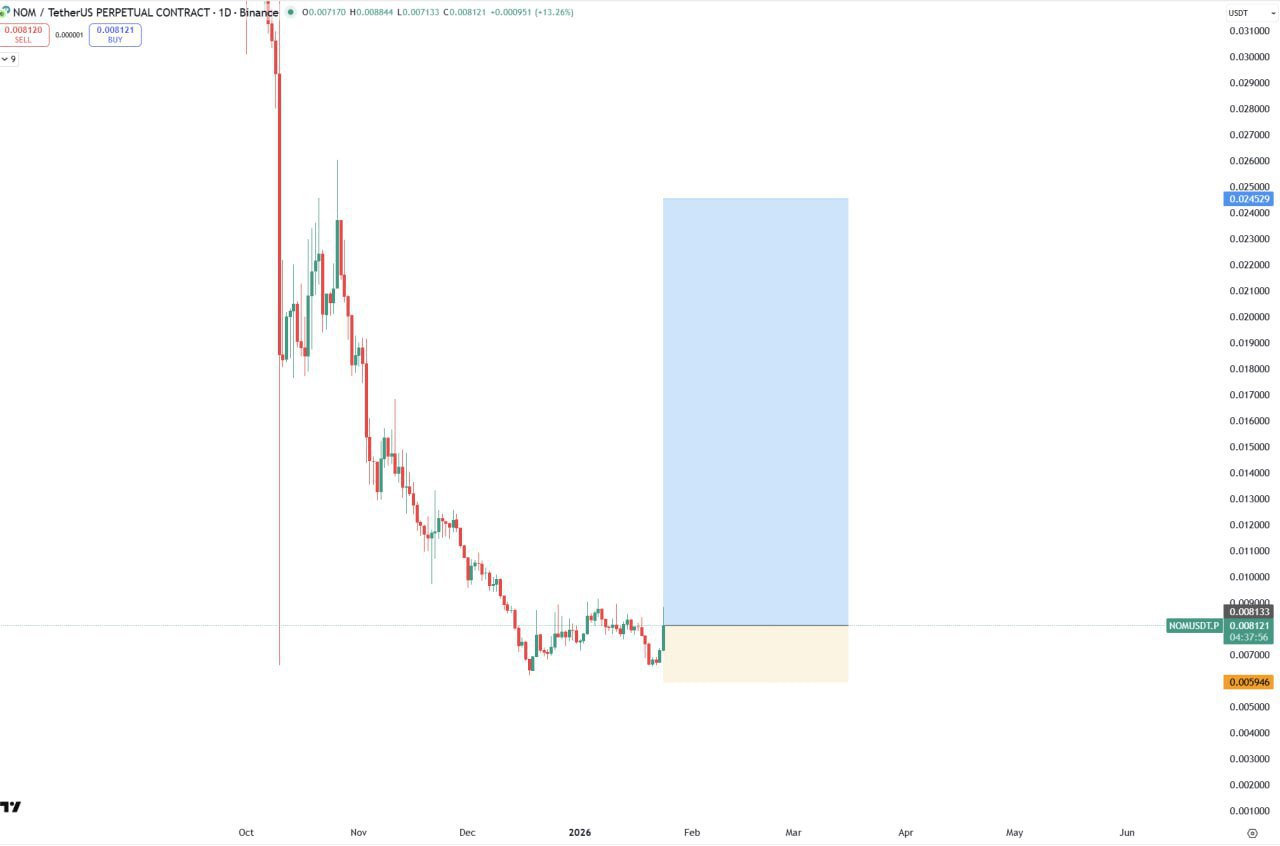

NOM Surges +70% — Market Alert

NOM spikes +70% — a fast market move traders should note. Quick alert for crypto and trading audiences. Join the discussion in our Telegram channel to learn more.

-

ENSO Hits $40M Market Cap — What’s Next?

ENSO reaches a $40M market cap. Is this the start of a breakout or a short-lived spike? Share your thoughts and join the discussion in our Telegram channel.

-

NOM Bullish — Quick Market Alert

NOM shows bullish momentum on the chart. Short market alert for traders and holders — potential upside with defined support/resistance. Discuss the setup and chart in our Telegram channel.

-

Crypto Chart Analysis: Key Support & Resistance Levels to Watch

Quick crypto chart analysis highlighting key support and resistance levels and trading implications — essential snapshot for traders and Bitcoin watchers.

-

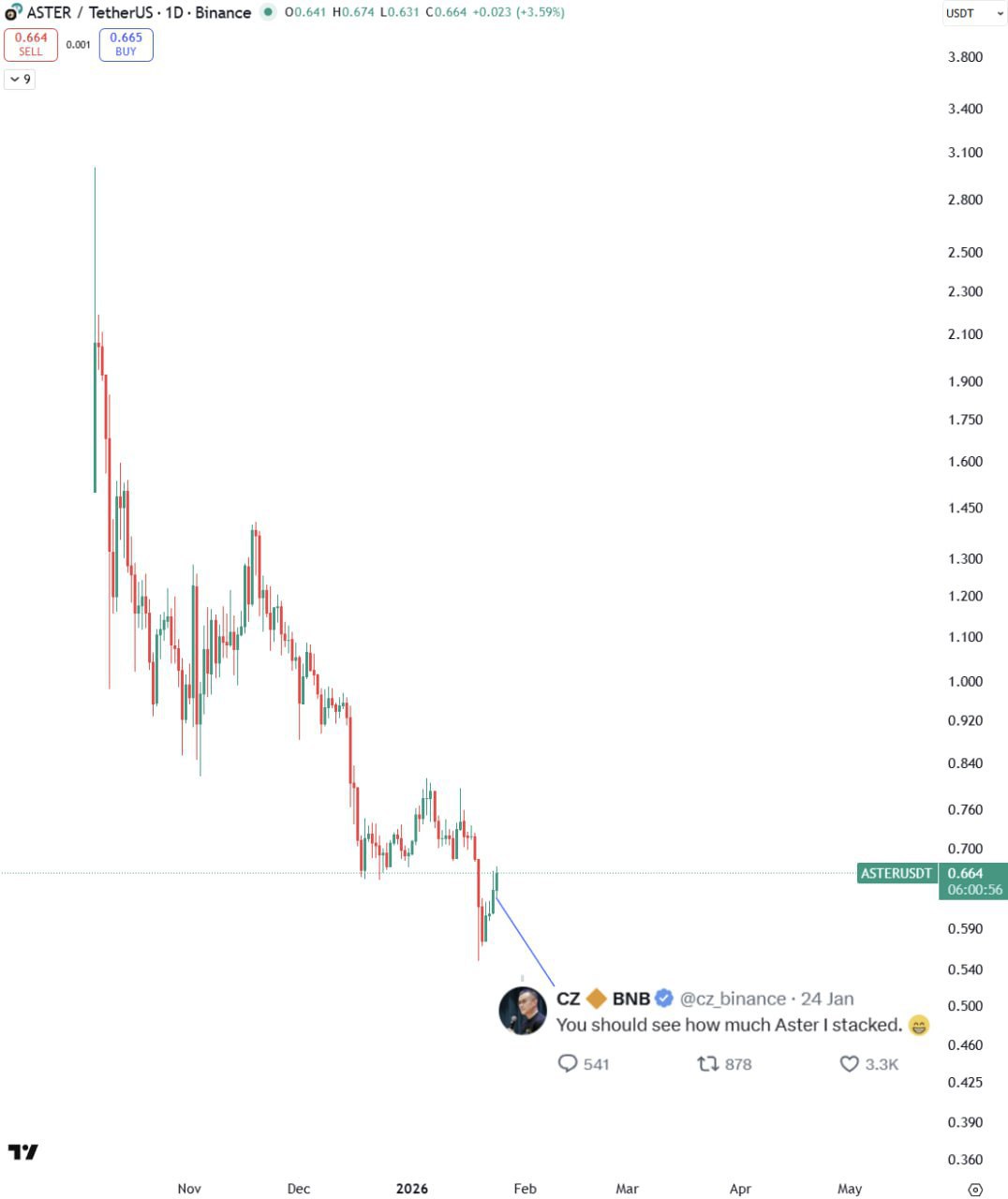

Signal Alert — ASTER Detected

Quick signal alert: ASTER has been detected. Short update posted — monitor ASTER for potential short-term moves and join our Telegram channel to discuss live reactions and insights.

-

ASTER Bullish — Chart Signals Potential Upside

Quick market note: ASTER shows a bullish chart pattern with support holding, suggesting potential upside. Check the short post and chart in our Telegram channel for a quick look.

-

Welcome to Crypto — A Beginner’s Gateway

Kickstart your journey into cryptocurrency. A quick welcome to the world of crypto — what to expect, how we’ll help, and why it matters.

-

Bullish 0G Trading Setup — Entry, Exit & Targets

Short analysis of a bullish trading setup for the 0G pair: clear entry, exit and target levels identified on the chart. Useful for swing traders and market analysts looking for high-probability setups.