Category: Analysis

-

Post‑April Market Update — Gold +40%, Bitcoin +50%, Silver +160%

Post‑April snapshot: Gold up 40%, Bitcoin up 50%, Silver up 160% — notable cross‑market rallies.

-

Top Is In — Crypto Market Top Alert

Short alert: “Top is in” — a potential crypto market peak. Read the brief post and join the discussion in our Telegram channel for deeper analysis and reactions. #crypto #MarketTop #roses_leaks

-

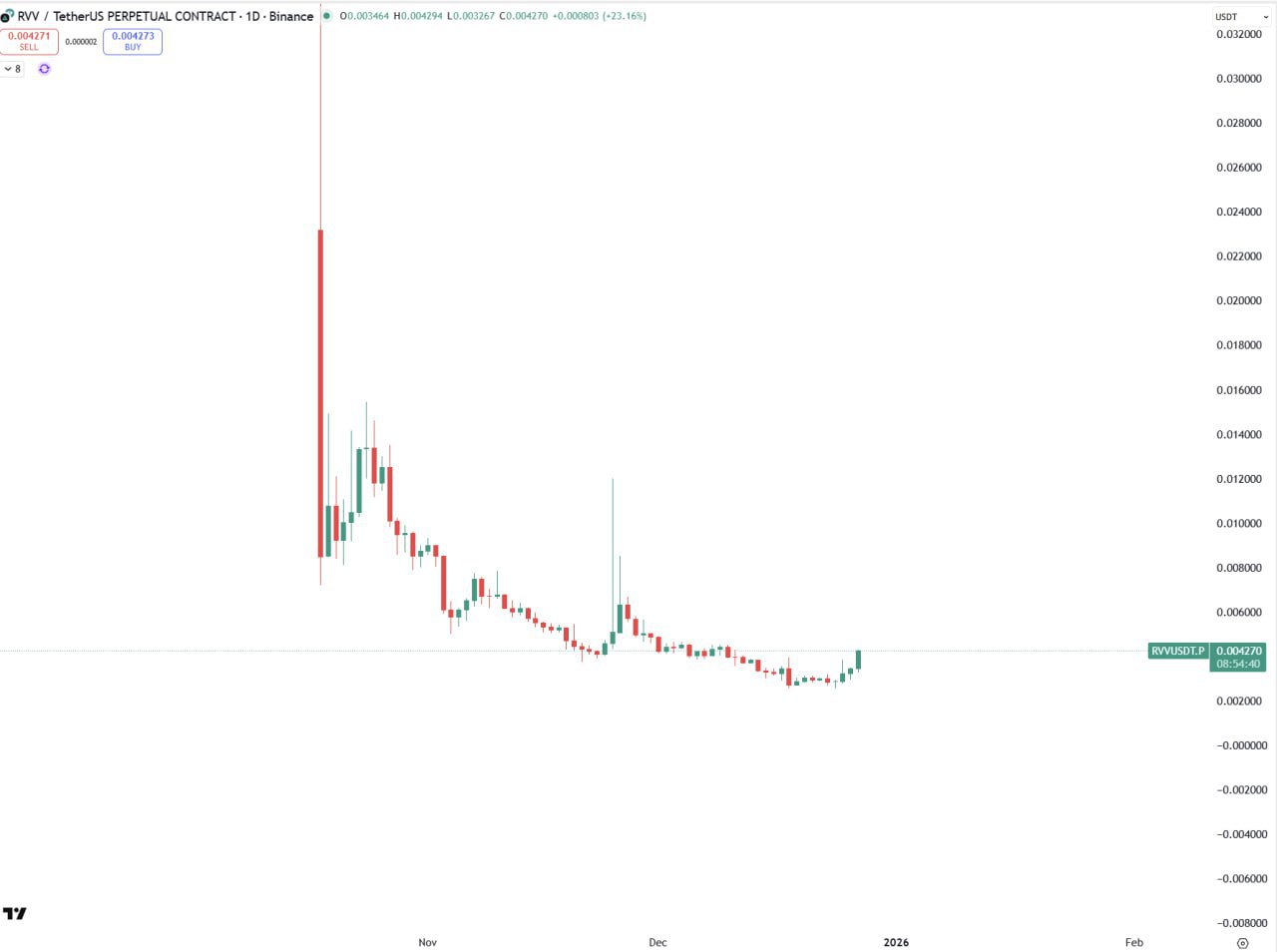

RVV Hits +20% — Time to Move Your Stop Loss

Quick market note: RVV surged 20%. If you were in the trade, consider adjusting your stop loss (SL) to lock in profits. Follow our channel for live updates and alerts.

-

Mentioned Coin Hits $4M Market Cap — Crazy Move

A coin mentioned yesterday surged to a $4M market cap — an unexpected move that captured attention across the crypto market. Quick update and discussion — join our Telegram channel to follow the chatter.

-

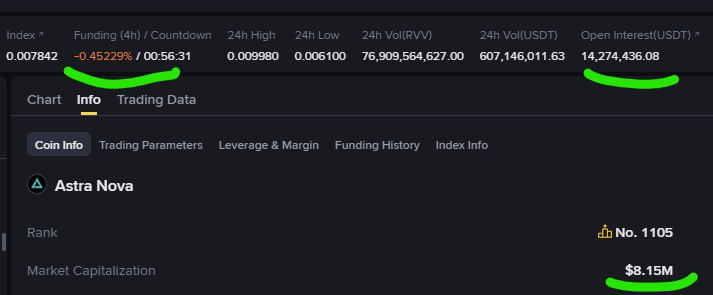

RVV Snapshot — $8M Market Cap, $14M Open Interest, Strong Negative Funding

Quick RVV market snapshot: $8M market cap, $14M open interest and heavily negative funding — a concise note for traders to assess potential bearish pressure.

-

RVV Bullish — Quick Market Note on RVV Momentum

Quick take: RVV is showing bullish momentum. Short market note highlighting positive sentiment and a bullish bias for RVV traders.

-

Reminder: Entry From the Bottom — Quick Trading Note

Quick reminder about entering from the bottom — a short trading note on timing and positioning in the crypto market.

-

PIPPIN & BEAT: Same Market Maker — Rose Family Prefers PIPPIN

Quick take: PIPPIN and BEAT show similar market-maker patterns, but the Rose Family signals favor PIPPIN — a short insight for traders watching token flows.

-

PIPPIN Bullish: Trading Setup Shows Potential Upside

PIPPIN shows a bullish trading setup vs USDT with a clear target area on the chart. Quick read for traders—join our Telegram channel for the full breakdown and discussion.

-

Missed BEAT — What’s Next for the Market?

Missed the beat — wondering what comes next for the market? Quick, focused look at possible next moves and what traders should watch: key levels, catalysts and scenarios to consider.